| Nigeria | Airtel Nigeria partners with AXA Mansard to launch USSD-based insurance service. Airtel Nigeria has partnered with Nigerian insurance company, AXA Mansard, to provide small-scale insurance services to Airtel users. Airtel Nigeria customers can now dial 987*7# and enrol for affordable health care plans. Afrikan Heroes |

| | EDITOR'S NOTE | While the industry has witnessed steady growth, insurance coverage in Nigeria is estimated to be a measly 2% of the adult population. Most of the insured population are through employment benefits in the formal sector. This leaves a significant and very vulnerable portion of the population without critical insurance protection.

Both financial and health services are heavily reliant on distribution, either offline or online. By leveraging Airtel Nigeria's large customer base, AXA Mansard could potentially offer insurance products to a significant part of the Nigerian population. While there is no indication of exclusivity, this could serve as a point of ancillary revenue for Airtel as well as provide deeper customer lock-in.

However, despite potential benefits, distribution does not always guarantee success; there are deep cultural barriers to adopting insurance protection in Nigeria that have historically been very hard to break down. Airtel and AXA Mansard might also have to do some significant education to drive conversion if they are to succeed. |

|

|

| Global | Wise files to go public via a direct listing. The UK fintech has made a formal regulatory filing to go public via a direct listing on the London Stock Exchange (LSE). At a reported $6-7B valuation, this is set to be the biggest valuation on the LSE. Brokers across the globe, including Africa, will be able to offer shares directly to both retail and institutional investors. TechCrunch |

| | EDITOR'S NOTE | Wise, which is currently a multi-currency wallet started out as Transferwise in 2010 as a cross-border money transfer service. This remittance service is currently available in 8 African countries with varied level of restrictions and success. African countries received about $48b in remittance flows in 2019, which amounted to 7% of global remittances. By leveraging its large base of available countries outside Africa and providing timely, cheaper channels, Wise is positioned to disrupt these ow and expensive legacy options. |

|

|

|

| Podcast | Are embedded financial services the future of banking in Africa? In the latest episode of the Voice of Fintech Podcast, Patrick Awori spoke to Hilda Moraa, CEO of Pezesh, a credit marketplace for SMBs about emerging trends in East African financial services. |

| | EDITOR'S NOTE | In Africa, we are seeing an emerging trend where digital non-financial services companies are offering financial services to their customers. By providing these services such as digital wallets, payments, credit and capital, these companies are looking to develop deeper relationship with customers and also increase their lifetime value. If this strategy proves to be successful and scalable, banks might find themselves in future competing for customer deposits not just with neo-banks and other fintechs but with your good ol' travel company. |

|

|

|

| Uganda | Airtel Uganda to break off mobile money operations Airtel Uganda has transferred ownership of Airtel Money to Airtel Mobile Commerce Uganda Limited (AMC Uganda). This was done to comply with the newly released National Payments Act 2020 that requires telcos to separate their mobile money businesses to operate. Techpoint |

|

|

| Nigeria | Chaka receives SEC's first digital broker license. The newly created Digital sub-broker license will allow platforms like Chaka facilitate the trade of stocks digitally. Prior to the creation of the license, digital platforms had to partner with local SEC-regulated brokerages to offer securities to Nigerian customers. The SEC had previously opposed the legitimacy of these partnerships but with this new regulation, digital investment platforms will now be directly regulated and monitored by the apex regulator. Financial Technology Africa |

|

|

|

| Africa | Google set to give out $6m in funding to African startups. The $6m fund consists of two initiatives: A $3m Black Founders Fund targeted at African entrepreneurs and a $3m google.org grant to Tony Elumelu Foundation (TEF) to support women in low-income communities with funding and training. Application for the funding closes July 7 and is open to startups in 13 African countries – including Botswana, Cameroon, Côte D’Ivoire, Ethiopia, Ghana, Kenya, Mozambique, Nigeria, Rwanda, South Africa, Tanzania, Uganda, and Zimbabwe. Google earmarks $6 million to support African tech startups and women-led businesses | TechCabal |

| | EDITOR'S NOTE | Important to note that the $3m Black Founder Fund is non-dilutive (i.e does not require an exchange for equity) also comes with millions of dollars worth of Google Cloud credits and ad grants. Cloud computing comes with relatively low marginal costs and high switching costs. By offering both capital and cloud access, Google recognises that these startups need money to scale but also will find it hard to switch providers once that scale is reached. |

|

|

|

| Did you know? |

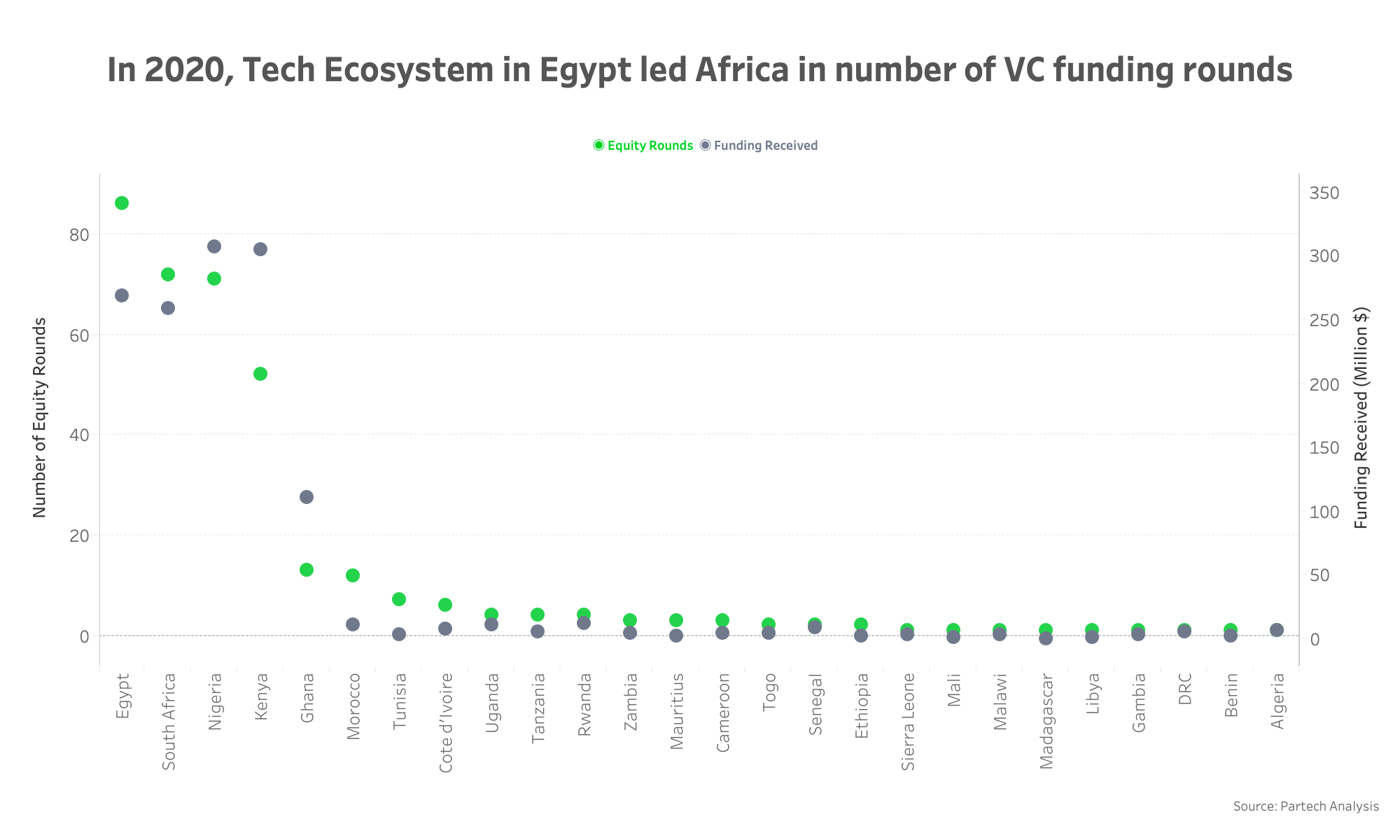

Egypt had the most number of funding rounds in 2020 with a total of 86 funding rounds. This is despite coming third place in total funding received during the year with $269m received. South Africa, Nigeria, and Kenya followed with Egypt with 72, 71, and 52 total funding rounds respectively. Nigeria received a total of $307m in funding, while Kenya received a total of $305m, then Egypt, and then South Africa with $259m. The total VC funding received in Africa was $1.4b in 2020 and is projected to almost double to $2.8bn in 2021. |

|

|

|

Share a tip | Do you have an announcement, event, or job posting you'd like to share, or have you come across an interesting bit of African fintech news recently? Hit reply and let me know! I might be able to include it in next week's newsletter. |

|

Know someone who'd enjoy Decode Fintech? |

|

|

|

|